资讯详情

Jinyi Culture ingeniously casts a variety of gold investment premium products to help consumers' assets grow steadily

- Origin:

- Views:

(Summary description)The new crown epidemic has hit the global economy, and various industries have suffered a cold winter. As the smallest unit of the economy, families and individuals cannot be left alone. The importance of asset allocation and investment and financial management is self-evident. Bank deposits, as one of the most common investment and financial management methods, are widely recognized and accepted by people, but relatively low risks correspond to relatively limited investment returns; compared with bank deposits, stocks, funds, trusts, etc. Investment and wealth management products often help the rapid growth of personal wealth through high returns and steady returns. Among these various types of investment and financial products, the project that is considered the most valuable and has the most market potential is gold investment.

On October 29, the World Gold Council released a gold demand trend report. The report shows that from the beginning of the year to the end of the third quarter, total global gold demand was 2972.1 tons, a year-on-year decline of 10%. Under the continuing impact of the new crown pneumonia epidemic, global gold demand in the third quarter was 892 tons, a year-on-year decrease of 19%. Although the overall demand for gold has declined, global gold investment demand in the third quarter rose sharply, with a year-on-year increase of 21%. Global investors purchased a total of 222.1 tons of gold bars and gold coins, and increased their holdings of 272.5 tons of gold through gold ETFs. It is worth noting that although the rise in gold prices in July dampened the enthusiasm of domestic consumers to buy gold jewellery, the demand for gold jewellery rebounded in the latter part of the third quarter as the price of gold fell 10% from the peak in August.

Gold has long been a good hedging tool. The key to gold's hedging is its high value and independent resource attributes. Gold is not restricted to any country or trade market, and has no involvement with companies or governments. On the one hand, when the world’s political and economic conditions are unstable, especially when wars and economic crises occur, common investment tools, such as funds and stocks, will be severely impacted. Only the price of gold can remain unchanged or even rise steadily. , Preserving the value of assets. On the other hand, gold is also an excellent asset against inflation and credit risks. When global currencies are loose, banknotes depreciate, and prices soar, the price of gold rises. Since 2020, international gold prices have broken through historical highs, with a half-year return of more than 35%, leading the world among major asset classes.

Buy gold as a hedge, physical gold is the best, and ordinary gold bars are the first. Ordinary gold bars are gold being poured into blocks and printed with manufacturer's name, fineness, weight, etc. The price of ordinary gold bars is closest to the price of raw gold. In addition, in order to be able to sell in time when hedging risks, we must choose gold bars produced by well-known manufacturers.

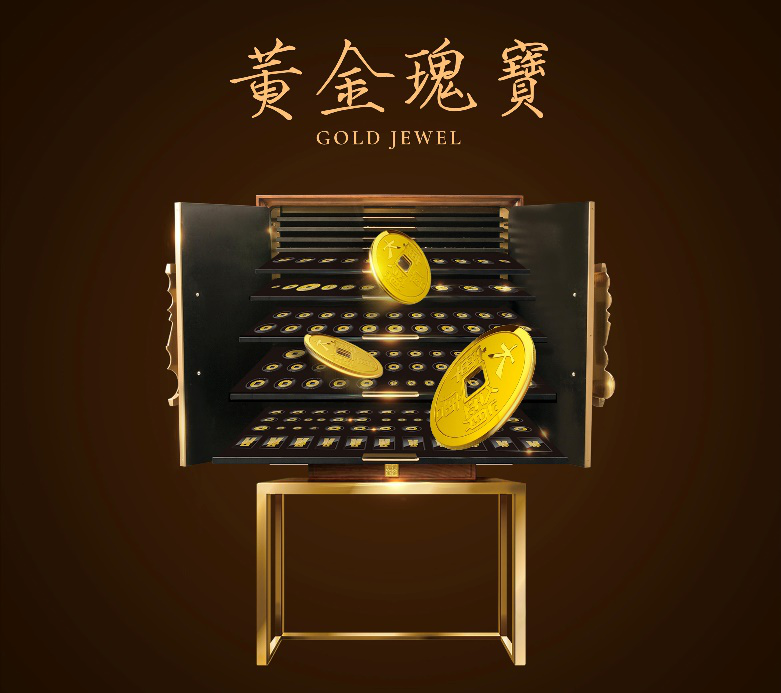

As one of the leading companies in the domestic gold jewelry cultural and creative product industry, Jinyi Culture has always created quality with ingenuity and insisted on the meticulous craftsmanship of gold jewelry products, aiming to bring consumers a high-quality consumer experience. The brand Jinyi also adheres to the group’s consistent philosophy. The investment gold bars it produces are simple and generous in design, using simple plastic packaging that can reflect the value of gold investment, maximizing the investment attributes of the product, and fully displaying the noble and bright texture of gold. All are engraved with the brand logo, close to the international gold price, support online repurchase, national inspection certificate guarantee, one certificate for each certificate, scan the code to verify the authenticity, it is the best choice for investment collection.

Gold is a precious metal with high credibility and convenient transfer of mortgage gifts. The gold market is huge, and there are many forms of gold trading at any time. In the case of the need for capital turnover, because gold has a high degree of recognition, it is an internationally recognized item and an absolute wealth in the world, so there is no need to worry about buyers. Whether applying for a loan from a bank or a pawn, it is the best collateral.

As the backbone of the gold jewelry industry chain, Jinyi Culture, Silver and Post Division is responsible for the design, research and development, production, and manufacturing of products under the brand, as well as the marketing, service, consulting, and management of major products in banks and postal channels. Since its establishment, it has successively cooperated with excellent production suppliers and higher design colleges to create numerous artistic products in the precious metal field, becoming a pioneer in the precious meta

Jinyi Culture ingeniously casts a variety of gold investment premium products to help consumers' assets grow steadily

(Summary description)The new crown epidemic has hit the global economy, and various industries have suffered a cold winter. As the smallest unit of the economy, families and individuals cannot be left alone. The importance of asset allocation and investment and financial management is self-evident. Bank deposits, as one of the most common investment and financial management methods, are widely recognized and accepted by people, but relatively low risks correspond to relatively limited investment returns; compared with bank deposits, stocks, funds, trusts, etc. Investment and wealth management products often help the rapid growth of personal wealth through high returns and steady returns. Among these various types of investment and financial products, the project that is considered the most valuable and has the most market potential is gold investment.

On October 29, the World Gold Council released a gold demand trend report. The report shows that from the beginning of the year to the end of the third quarter, total global gold demand was 2972.1 tons, a year-on-year decline of 10%. Under the continuing impact of the new crown pneumonia epidemic, global gold demand in the third quarter was 892 tons, a year-on-year decrease of 19%. Although the overall demand for gold has declined, global gold investment demand in the third quarter rose sharply, with a year-on-year increase of 21%. Global investors purchased a total of 222.1 tons of gold bars and gold coins, and increased their holdings of 272.5 tons of gold through gold ETFs. It is worth noting that although the rise in gold prices in July dampened the enthusiasm of domestic consumers to buy gold jewellery, the demand for gold jewellery rebounded in the latter part of the third quarter as the price of gold fell 10% from the peak in August.

Gold has long been a good hedging tool. The key to gold's hedging is its high value and independent resource attributes. Gold is not restricted to any country or trade market, and has no involvement with companies or governments. On the one hand, when the world’s political and economic conditions are unstable, especially when wars and economic crises occur, common investment tools, such as funds and stocks, will be severely impacted. Only the price of gold can remain unchanged or even rise steadily. , Preserving the value of assets. On the other hand, gold is also an excellent asset against inflation and credit risks. When global currencies are loose, banknotes depreciate, and prices soar, the price of gold rises. Since 2020, international gold prices have broken through historical highs, with a half-year return of more than 35%, leading the world among major asset classes.

Buy gold as a hedge, physical gold is the best, and ordinary gold bars are the first. Ordinary gold bars are gold being poured into blocks and printed with manufacturer's name, fineness, weight, etc. The price of ordinary gold bars is closest to the price of raw gold. In addition, in order to be able to sell in time when hedging risks, we must choose gold bars produced by well-known manufacturers.

As one of the leading companies in the domestic gold jewelry cultural and creative product industry, Jinyi Culture has always created quality with ingenuity and insisted on the meticulous craftsmanship of gold jewelry products, aiming to bring consumers a high-quality consumer experience. The brand Jinyi also adheres to the group’s consistent philosophy. The investment gold bars it produces are simple and generous in design, using simple plastic packaging that can reflect the value of gold investment, maximizing the investment attributes of the product, and fully displaying the noble and bright texture of gold. All are engraved with the brand logo, close to the international gold price, support online repurchase, national inspection certificate guarantee, one certificate for each certificate, scan the code to verify the authenticity, it is the best choice for investment collection.

Gold is a precious metal with high credibility and convenient transfer of mortgage gifts. The gold market is huge, and there are many forms of gold trading at any time. In the case of the need for capital turnover, because gold has a high degree of recognition, it is an internationally recognized item and an absolute wealth in the world, so there is no need to worry about buyers. Whether applying for a loan from a bank or a pawn, it is the best collateral.

As the backbone of the gold jewelry industry chain, Jinyi Culture, Silver and Post Division is responsible for the design, research and development, production, and manufacturing of products under the brand, as well as the marketing, service, consulting, and management of major products in banks and postal channels. Since its establishment, it has successively cooperated with excellent production suppliers and higher design colleges to create numerous artistic products in the precious metal field, becoming a pioneer in the precious meta

- Categories:KINGEE News

- Author:

- Origin:

- Time of issue:2020-11-16 18:08

- Views:

The new crown epidemic has hit the global economy, and various industries have suffered a cold winter. As the smallest unit of the economy, families and individuals cannot be left alone. The importance of asset allocation and investment and financial management is self-evident. Bank deposits, as one of the most common investment and financial management methods, are widely recognized and accepted by people, but relatively low risks correspond to relatively limited investment returns; compared with bank deposits, stocks, funds, trusts, etc. Investment and wealth management products often help the rapid growth of personal wealth through high returns and steady returns. Among these various types of investment and financial products, the project that is considered the most valuable and has the most market potential is gold investment.

On October 29, the World Gold Council released a gold demand trend report. The report shows that from the beginning of the year to the end of the third quarter, total global gold demand was 2972.1 tons, a year-on-year decline of 10%. Under the continuing impact of the new crown pneumonia epidemic, global gold demand in the third quarter was 892 tons, a year-on-year decrease of 19%. Although the overall demand for gold has declined, global gold investment demand in the third quarter rose sharply, with a year-on-year increase of 21%. Global investors purchased a total of 222.1 tons of gold bars and gold coins, and increased their holdings of 272.5 tons of gold through gold ETFs. It is worth noting that although the rise in gold prices in July dampened the enthusiasm of domestic consumers to buy gold jewellery, the demand for gold jewellery rebounded in the latter part of the third quarter as the price of gold fell 10% from the peak in August.

Gold has long been a good hedging tool. The key to gold's hedging is its high value and independent resource attributes. Gold is not restricted to any country or trade market, and has no involvement with companies or governments. On the one hand, when the world’s political and economic conditions are unstable, especially when wars and economic crises occur, common investment tools, such as funds and stocks, will be severely impacted. Only the price of gold can remain unchanged or even rise steadily. , Preserving the value of assets. On the other hand, gold is also an excellent asset against inflation and credit risks. When global currencies are loose, banknotes depreciate, and prices soar, the price of gold rises. Since 2020, international gold prices have broken through historical highs, with a half-year return of more than 35%, leading the world among major asset classes.

Buy gold as a hedge, physical gold is the best, and ordinary gold bars are the first. Ordinary gold bars are gold being poured into blocks and printed with manufacturer's name, fineness, weight, etc. The price of ordinary gold bars is closest to the price of raw gold. In addition, in order to be able to sell in time when hedging risks, we must choose gold bars produced by well-known manufacturers.

As one of the leading companies in the domestic gold jewelry cultural and creative product industry, Jinyi Culture has always created quality with ingenuity and insisted on the meticulous craftsmanship of gold jewelry products, aiming to bring consumers a high-quality consumer experience. The brand Jinyi also adheres to the group’s consistent philosophy. The investment gold bars it produces are simple and generous in design, using simple plastic packaging that can reflect the value of gold investment, maximizing the investment attributes of the product, and fully displaying the noble and bright texture of gold. All are engraved with the brand logo, close to the international gold price, support online repurchase, national inspection certificate guarantee, one certificate for each certificate, scan the code to verify the authenticity, it is the best choice for investment collection.

Gold is a precious metal with high credibility and convenient transfer of mortgage gifts. The gold market is huge, and there are many forms of gold trading at any time. In the case of the need for capital turnover, because gold has a high degree of recognition, it is an internationally recognized item and an absolute wealth in the world, so there is no need to worry about buyers. Whether applying for a loan from a bank or a pawn, it is the best collateral.

As the backbone of the gold jewelry industry chain, Jinyi Culture, Silver and Post Division is responsible for the design, research and development, production, and manufacturing of products under the brand, as well as the marketing, service, consulting, and management of major products in banks and postal channels. Since its establishment, it has successively cooperated with excellent production suppliers and higher design colleges to create numerous artistic products in the precious metal field, becoming a pioneer in the precious metal blue ocean market and maintaining a dominant position in the industry, winning the consensus of the banking and postal channel market Praise. Its "Fuyun Golden Beans" product breaks through the single design of traditional investment gold bars, changing the square to a circle, and casting 999.9 gold into a round gold bean, which is stored in a test-tube-shaped gold container. Each gold bean is Symbol of wealth and vitality. It can be used as investment, gift, and heirloom collection. It is a new fashion investment fund that integrates culture, aesthetics and investment concepts.

In the domestic market, there are both the Shanghai Gold Exchange and Shanghai Futures Exchange's on-exchange markets, as well as the off-exchange businesses of major banks and gold shops, with various investment methods. In terms of trading operations, gold supports 24 hours a day trading and T+0 mode, as well as two-way trading, with more profit opportunities.

Jinyi Culture was established on November 26, 2007, with a registered capital of 95.9925877 million yuan. It was listed on the Shenzhen Stock Exchange on January 27, 2014, with stock code 002721. The actual controller is the Haidian District SASAC. The company's main business is the R&D, design, production and sales of precious metal crafts and jewelry. Since its establishment, it has been adhering to the product development concept of "Let gold tell culture and culture interpret gold", and continue to bring high-quality gold jewelry products that satisfy consumers.

Scan the QR code to read on your phone